Bears! The bane of hikers, salmon and investors alike. NFT collectors have been loudly lamenting the current market conditions we find ourselves in and thinking back longingly to the “good ole days”. But, are we actually in a bear market? Twitter sentiment says we are, but what do the numbers say? What does history tell us?

What if I told you the bull actually never went away? Volumes never really changed. What if I told you, your worthless crap is just worthless crap? The market analytics may just surprise you.

Let us first explore history, then we will get back to our current market. Like any good mania, “investors”, “founders” and “artist” flocked to the NFT PFP space. Much has been made about how this resembles the Dutch Tulip Mania of the 17th century. Let’s separate the wheat from the chaff.

Tulips- Fact or Fiction?

Many of us have heard the stories. The first financial bubble. The Dutch and their tulips. How much of the story is actually true though? What can we learn from it with NFTs? Well, historian Anne Goldgar wanted to find out just how much of this famous fable actually happened. A professor of early modern history at King’s College London. She authored “Tulipmania: Money, Honor and Knowledge in the Dutch Golden Age“.

While digging into history, her first finding was that there wasn’t actually an irrational and widespread tulip craze. It was more a relatively small and short-lived market for an exotic luxury item.

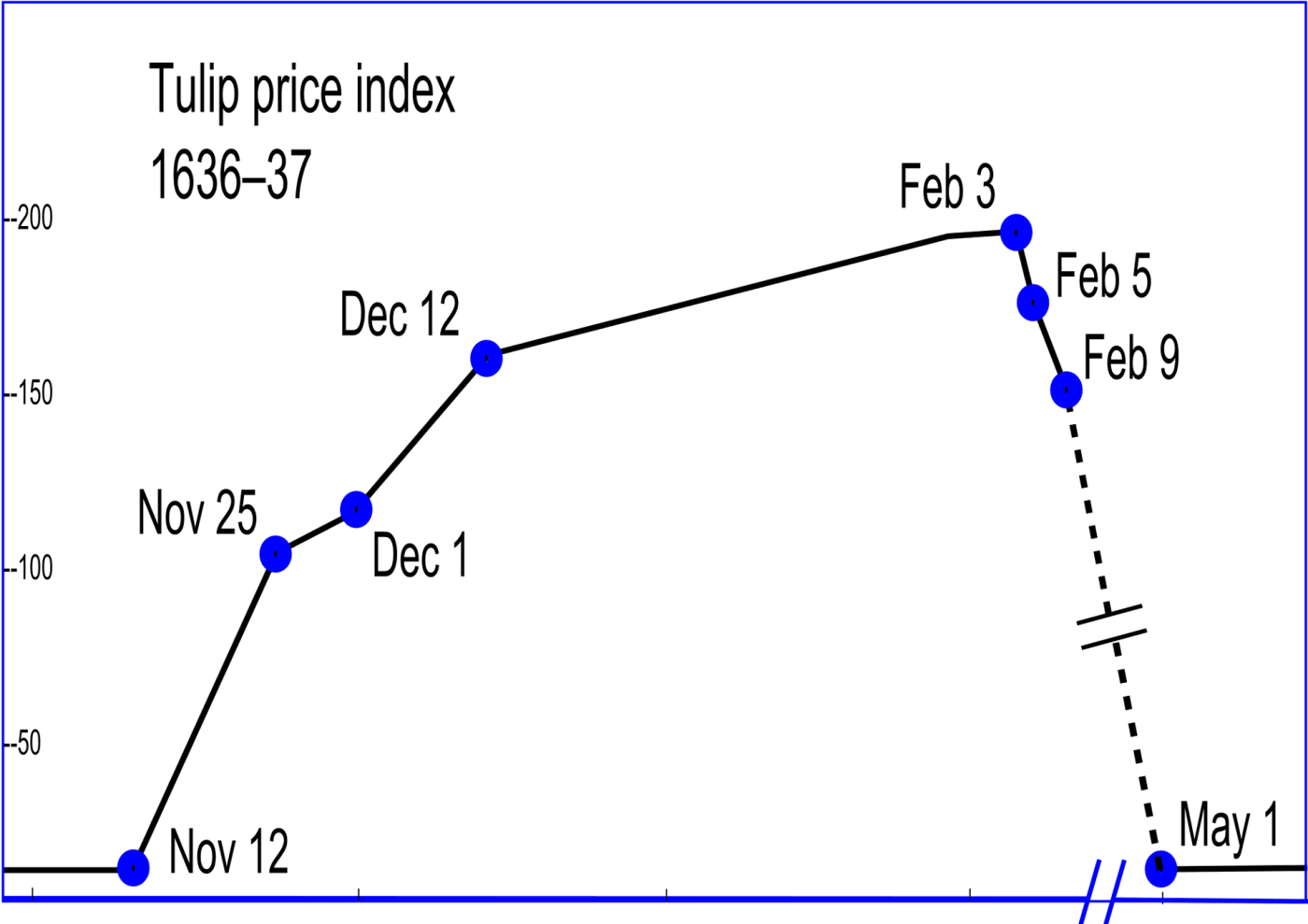

What did actually happen? Well for starters, tulip prices did indeed spike from December 1636 to February 1637. Some of the most prized bulbs, like the coveted Switzer, experienced a 12-fold price jump. The most expensive tulip receipts that Goldgar found were for 5,000 guilders, the going rate for a nice house in 1637. Sound like a Bored Ape to anyone else? The interesting finding though was those exorbitant prices were outliers. She only found 37 people who paid more than 300 guilders for a tulip bulb, the equivalent of what a skilled craftsman earned in a year. Gang Gang perhaps?

So it went up fast, and down just as quick. Perhaps the best part of this story is trades were all conducted in taverns and each transaction had a 2.5% fee to pay for wine. They actually charged the exact same fee as Broken Sea. At least with the Dutch you got some wine out of the deal!

In the end Goldgar only identified about 350 people who were involved in the trade. Given she was dealing with 300 year old records, it is not exactly an audited figure. It does show however the bubble was not all that wide spread. Apparently the 17th century also had echo chambers, who knew?

Ultimately the tulip craze never regained its runaway prices. A niche market of a few select individuals trading the same liquidity back and forth did not translate into generational wealth. Hmmmmm, this is starting to sound poignant. So circling back to our current NFT market, what do the numbers tell us? I think this may surprise a lot of people.

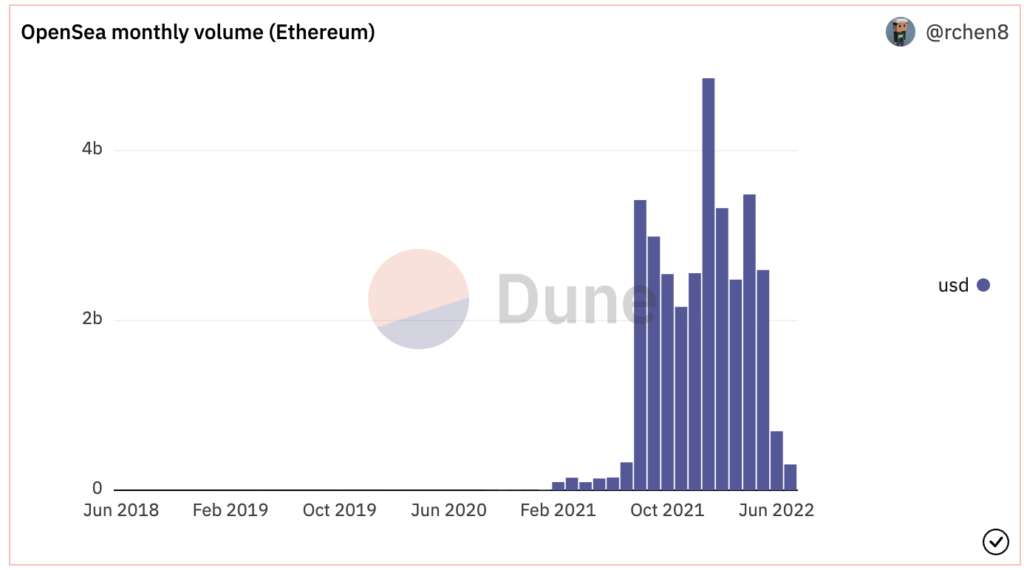

NFT volume as measured in USD was higher in Q1 of 2022 than most of 2021. This is despite the fact Eth was falling during this time. More Eth was required per transaction to hit the same USD values.

Eth peaked in September, USD of NFTs began to follow it down, but reversed course and spiked in December. With Eth about 30% lower than it was in the fall, USD values early this year were exceeding the fall highs. It wasn’t until Eth (and every other market) fell off a cliff in June that NFT monthly USD values sank. Total value of NFTs traded on Eth in June 2022 basically matched those from July 2021. Even though Eth was worth about 50% less in 2022 than in 2021.

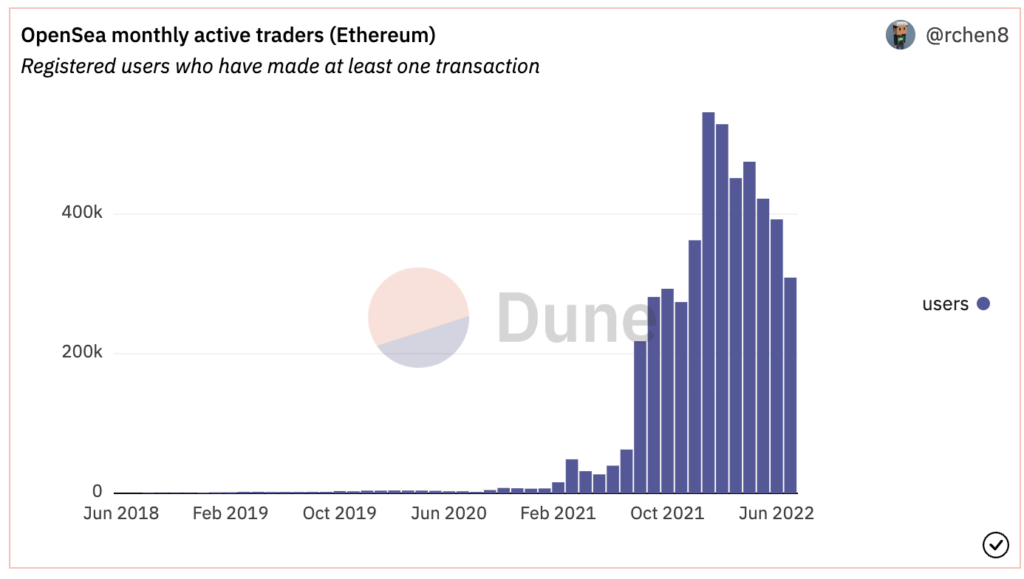

The number of active users has remained strong, peaking in January 2022. Though, even the number of active users in June 2022 has exceeded the count from each month in the fall of 2021.

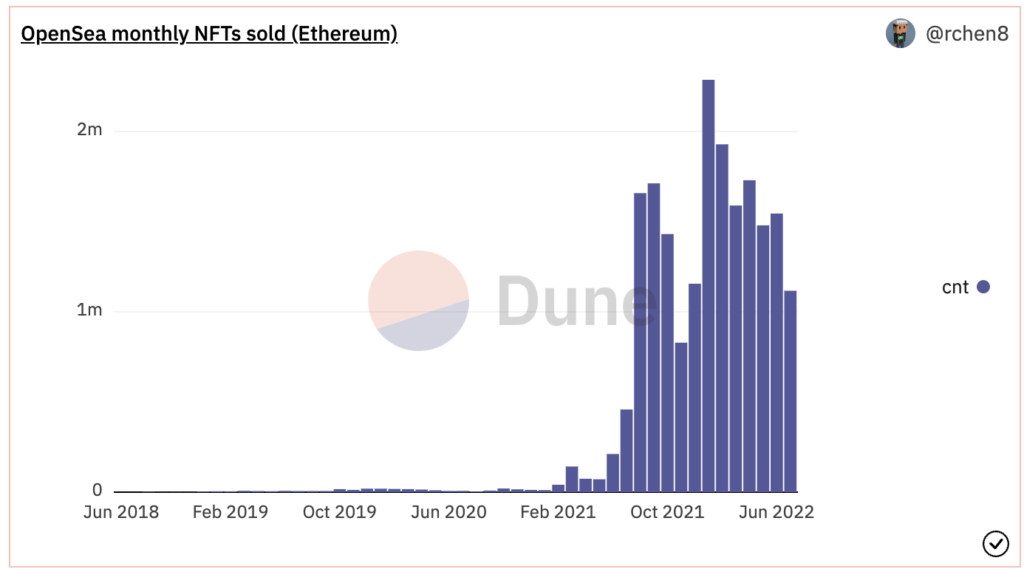

So what has gone up exponentially? The number of collections available. AKA, how much crap has flooded the market.

TLDR

Numbers, charts and pretty flowers. What does it all mean? Why TF do I care Canuck? I know, I know, bear with me here (pun intended). The worst lies are the ones we tell ourselves. We have heard numerous time, once the market resumes my bag will be worth generational wealth. After all, we’re all early, right? RIGHT? Well, maybe not.

The PFP NFT craze had a nice little run. Some people made money, some just accumulated more and more with their “profits”. I have not been shy in sharing my thoughts on “A much needed change” . We talk a lot in the space about being nimble, well now is the time for that. Read the tea leaves.

Memory is often the enemy of wealth. This is caused by “recency bias”. It’s when people make decisions based on recent events, expecting that those events will continue into the future. Aka, I made 12X on PFP NFTs so I can do it again.

Supply (number of available NFT collections) has increased about 250% since October 2021 and a whopping 1,000% since July. This means the amount of liquidity needed to raise the market has also increased by the same amount. It also means the number of projects you need to pay attention to is dramatically higher. Simple terms, it is 10X harder to do in July 2022 what you did in July 2021. The conditions are just different. Just as the Dutch couldn’t rely on a 12X return in a few weeks, your PFP likely isn’t gonna moon after mint.

Where do we go from here?

People need to read, and research. I have observed this not a popular pasttime in web3. You are far more likely to find an easy rug than easy money. I can already hear many of you saying, Ya but, ya but, ya but…… Goblins mooned Canuck. There will always be a few projects that beat the odds. Always will be. The key word here be a FEW, as in not very many. It is back to being a lottery ticket. Lloyd Christmas may like those odds, but I don’t.

Bear?

So, is it a bear? In my not so humble opinion, NO! Volumes stayed relatively constant (or grew). Average transaction size and average transaction value did the same. The big change was a massive influx in supply, most of them cheap knockoffs. Dilution of the market is not a bear. NFTs are still a thriving market, it has just changed. A LOT! It will change a lot more. In part two of this article I will jump into what that change will, could and should look like. In the mean time, have a beer and maybe catch a fish. At the very least, stop and smell the tulips.

2 thoughts on “NFTs- Pt. 1, Did the bull never stop?”