NFT PFPs have received a bad rap of late. I have been one of their harshest critics on this page. Though much of my criticism has been nuanced, I have maintained a pretty strident tone. I am happy however to see a dramatic reduction in project launches. Perhaps just because the allure of easy fast money has left the space. I think this is now a fantastic opportunity for NFTs to grow up a little and launch the next phase in development.

Economic realities

When Jerome Powell stepped up to the podium in Jackson Hole two weeks ago, markets tanked. The Dow Jones alone lost $1.2T in market cap. That money didn’t vanish however, it simply converted into USD (aka dry powder). More and more liquidity has done this as interest rates have gone up.

Similar effects were felt across the crypto market. The values of BTC, Eth and alts collectively took a beating. Given this happened across all asset classes I find it less important in my long term view of crypto, NFTs and Web3.

NFTonomics

Data specific to NFT collections is a little more difficult to come by. The last reliable number I saw was in April and there were a little more than 5,000 collections for sale on OpenSea. Looking at the recent sales volume right now, only 42 projects have a floor price of 1Eth or higher. Let’s just round to 1%, everyone loves talking about the 1% these days anyways :). I think overall it is fair to call this 1% of projects the Blue Chips.

It is important to view NFT information a little differently from other asset classes given how new it is. BTC and Eth have been through several more economic cycles than NFTs. It is fair to say however, we are already seeing separation. Some projects are truly investment grade while many others (perhaps as much as 95%) are copy and paste crap. Today I am going to focus in strictly on those which have actual people and development behind them.

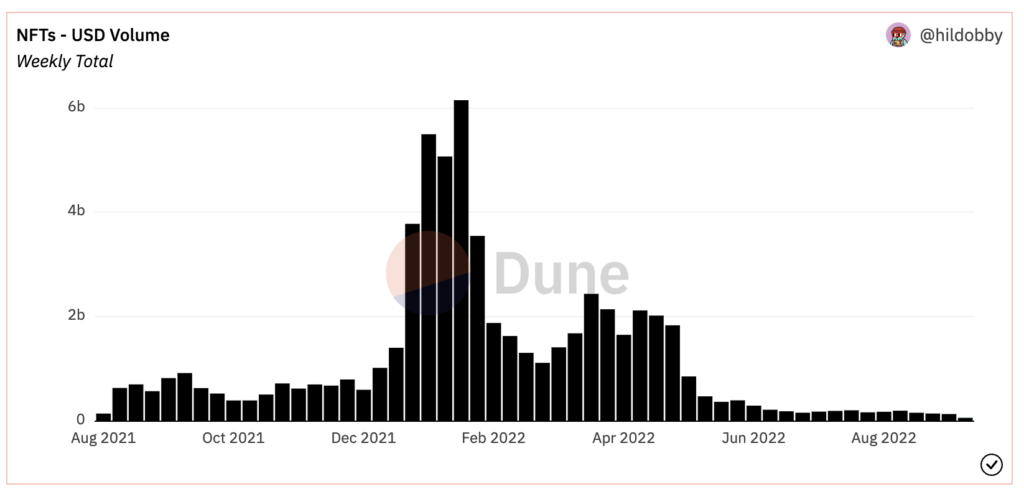

Sales data

When we look at the overall market sales data of NFTs for the past year a few things jump out. For starters Looks Rare wash trading really artificially inflated the market numbers for a while. I am not going to dive into that here, but assume most of the light green volume is fake. (Oversimplified so don’t @ me). Secondly, before the volume fell off a cliff at the end of June of this year, sales had been relatively consistent month over month.

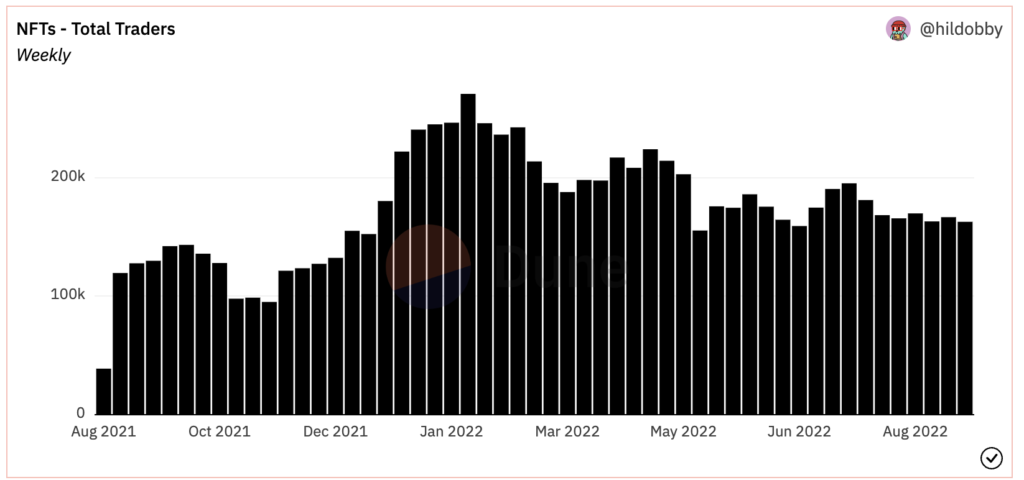

Who’s buying?

More interestingly, the number of active traders of NFTs has remained remarkably constant (even through the summer lull). I view this as both a good and a bad thing. The trouble is, the Eth based liquidity is just being bounced back and forth between the same few users. Someone needs to sell an Ape to free up the Eth to buy a Doodle or a horse-drawn-carriage full of Goblins. This doesn’t actually create new liquidity. Tough for the space to grow in these circumstances.

So what will attract new users, investors and ultimately liquidity to NFTs? In this guy’s humble opinion, PASSION.

Focus on builders

The simple fact is, very few people get things right the first time. There are plenty of talented developers out there who have no artistic talent. Similarly, plenty of talented artists couldn’t sell water to someone lost wandering the Sahara. NFT projects are a business. Successful businesses require a diverse group of people with opposite but complementary skillsets.

There’s an abundance of artists, devs and creators whose first project “failed” but they are still building and learning in the background. They are identifying what went wrong and partnering with other people of different skillsets. Many will learn from this experience and their second, third or fourth project will moon down the road.

Lots of famous artists died penniless, only to have their art sell for millions in the years following their death. This means a few random 10K projects that only had 259 NFTs minted will be worth a fortune at some indeterminate point in time. I can foresee YouTube channels dedicated to Modern day NFT treasure hunters, akin to Antiques Roadshow. According to Google, the show is into its 22nd season on PBS so the concept continues to be popular. Maybe someone from NRN will do this? Hint hint!

Bet on people

As I was researching and working on this piece, I had a very interesting conversation with fellow NRN member Kyle, AKA Boona. He has been very vocal in his efforts to highlight artists who are creating cool stuff and working hard despite the market. He also does his best to highlight these builders in his PODS so do check them out.

Boona and I share the view, that many of the best bets in NFTs are hidden right now. I would like to bet on the artist who is building for the right reasons. We should all be supporting people who are thinking about things in new, creative ways. I have much respect for those who aren’t out for a quick buck, but are truly endeavouring to make a business out of their passion.

Invest in quality

Blue Chips and their next tier are solid investments right now. Pretty much every quality asset class is currently under valued. The good news in chaotic economic times, opportunities are everywhere. I don’t want to tell you what an Ape, a Doodle or a Gutter Cat will be worth in 6 or 24 month. It is pretty safe to assume it will be a lot more than it is now. There is plenty of data available at your fingertips to see which projects have held strong through the down market.

As with my comments about artists above, look for projects that have kept the dream alive throughout. Try to spend a day on Twitter and not read an “Arf” from someone in the Sappy Seal community. Those devs who are not on “mental health breaks” are a safe bet to move forward with. The good news is, the “dry powder” will soon be looking for a new home. Liquidity will be up for grabs and a good chunk of it will make its way to NFTs. This means the current fire sale will not last forever.

Being in an asset class where 95% of the product is complete garbage can be tough. We went through a time when it felt like every mint was going to moon, but we are past that now. Some have battle scars and a few lucky folks have profits. Through it all though, many people made friends while creating communities.

Wen profits?

I really dislike the term “we are early”. To me there is a certain lazy connotation to it. If you have lived through the boom and bust of the last year however, I believe you have an advantage. Hopefully you have paid attention and know what to look for moving forward. I have long said DCA is the way to go. If you are a believer in NFTs, I think this holds true. Don’t have enough Eth for the PFP you desire? Keep stacking Eth from every pay cheque. Perhaps most importantly, this is a good time to go bargain hunting based on who you see putting in the hours.

Success in this space, as measured in profits, can be distilled down to three other P words: Passion, Persistence and Patience. Invest in projects and people who demonstrate Passion and Persistence in what they are doing/ building. All the while, demonstrate Patience in HODLing these in your wallet. Sorry, ended up with a plethora of P words in that paragraph. Pun only partially intended. Until next time, keep your stick on the ice, hockey season is upon us.