One of the best qualities of investing in cryptocurrencies is the freedoms that come with the territory. The ability to lend, borrow, stake, and provide liquidity to any platform on any chain has become something that takes minutes to execute. It truly is a financial marvel.

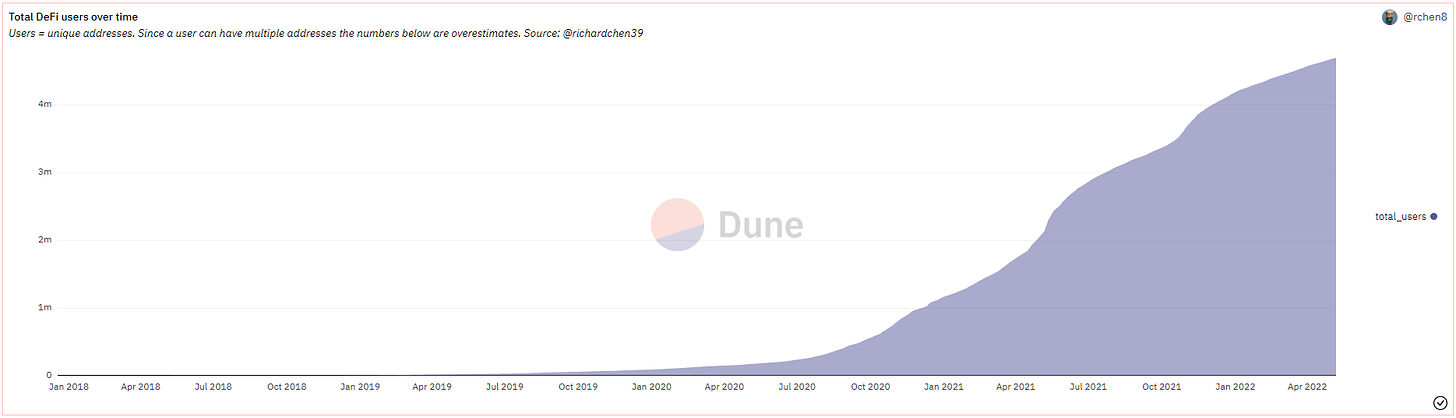

Since the invention of Automatic Market Makers (AMM) such as Uniswap and lending platforms such as Maker, investing in these sectors has exploded and contributed to the maturation of the global Crypto market. Defi protocols continue to evolve and support new assets, and I wanted to cover a few I have encountered expanding into the NFT sector for your illiquid JPEGs.

NFTX

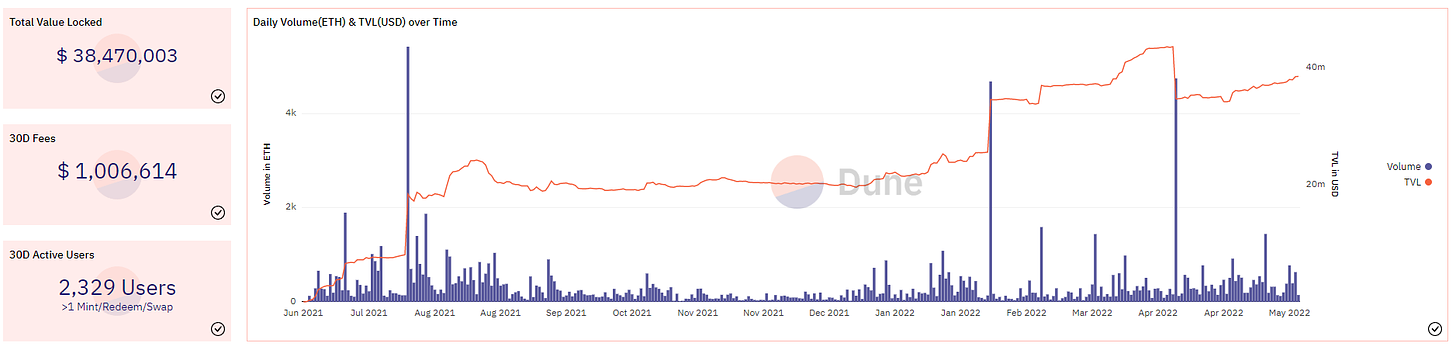

NFTX was the original platform that opened up some liquidity for your NFTs. The platform functions by creating liquid markets for illiquid Non-Fungible Tokens (NFTs).

Users deposit their NFT into an NFTX vault and mint a fungible ERC20 token (vToken) that you can sell for liquidity or redeem for an NFT in the vault. You may not be able to get your specific NFT back for this lending, so I would lend ones you are not using as your profile picture/attached to (the ugly ones).

Benefits include:

- LP and stake minted vTokens to earn yield rewards

- Better distribution and price discovery for NFT projects

- Instantly sell any NFT by minting it as an ERC20 and swapping via Sushiswap

- Increased liquidity for NFT investors and speculators

The drawback is that you turn your NFT into a liquid asset meaning all of these images become interchangeable. Imagine throwing your car keys in a bowl when you parked it and picking a new set ok keys when you want to leave; I hope it is nice.

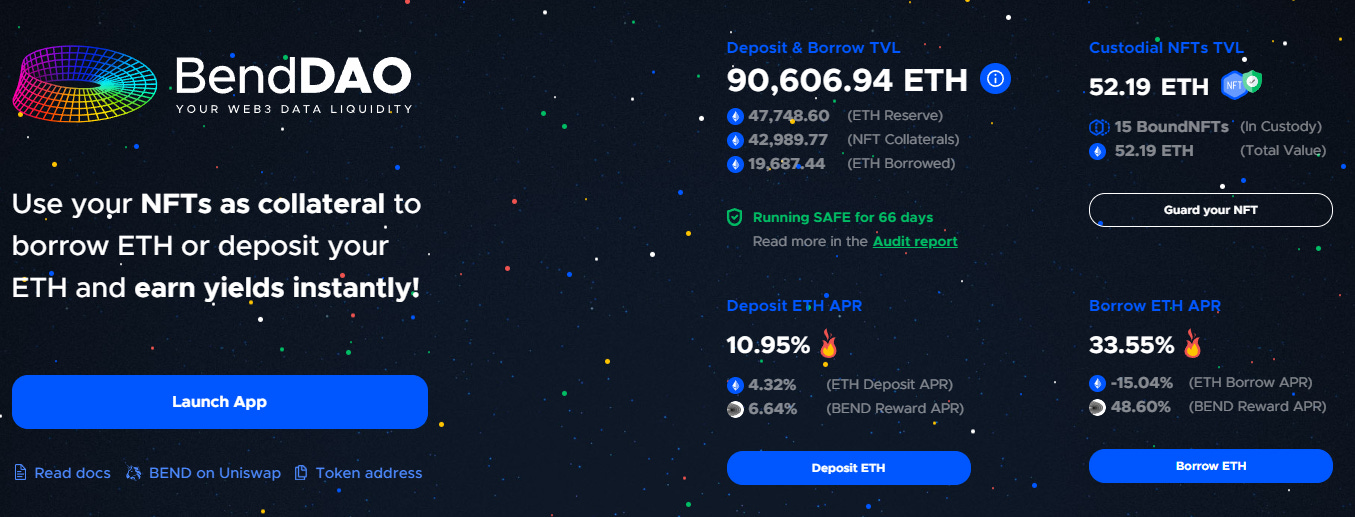

BendDAO

BendDAO is the first platform I have used for NFTs, and I am impressed. You do have to watch and manage the pool, similar to Maker or AAVE, so it isn’t set and forget. Still, to avoid losses caused by the market fluctuations, the borrower will have a 48-hour liquidation protection period to repay the loan.

Where this platform differs is Ethereum reserves directly back to NFT collateral. Lenders with free Ethereum can pool funds to back loans from DAO-approved assets. The platform offers only a select few NFTs to lend and borrow against.

- Bored Ape Yacht Club

- Doodles/ Space Doodles

- Azuki

- Clone X

- Mutant Ape Yacht Club

- Cryptopunks

for these few collections, it offers a great way to get extra liquidity out of your projects. While the platform is limited now, it will expand to more offerings as NFTs solidify as a new asset class over time.

Another benefit is incentivizing users onto the platform; you are getting roughly 48% in yield from their $bend token to offset the 15% APR lending fees. So accessing liquidity currently is profitable with the number of participants utilizing the platform. So, let’s break down some of the benefits.

Same airdrop right for borrowers

Borrowers will be eligible for all related NFT holder airdrops. BendDAO will collect and distribute the airdrops to boundNFT holders when their NFTs are in the collateral pool.

Furthermore, borrowers can claim NFT rewards on other protocols while having NFTs still in a collateral pool with the Flashloan feature.

Never be stolen

NFTs will be converted into representing ERC721 boundNFTs through instant NFT loans. boundNFT is nontransferable, avoiding the risk of theft. Conversely, boundNFT has the same digital self-expression, allowing use on Web2 social media platforms that support the NFT avatar.

Not long ago, none of this was available, and as more lending options become mainstream, NFTs will see the benefit. As we saw with the Boom of DeFi with the invention of AMMs, we will see massive growth in NFT lending as time progresses. The beauty of crypto is that constantly evolving systems accelerate innovation, and this is just a stepping stone linking DeFi and NFTs.